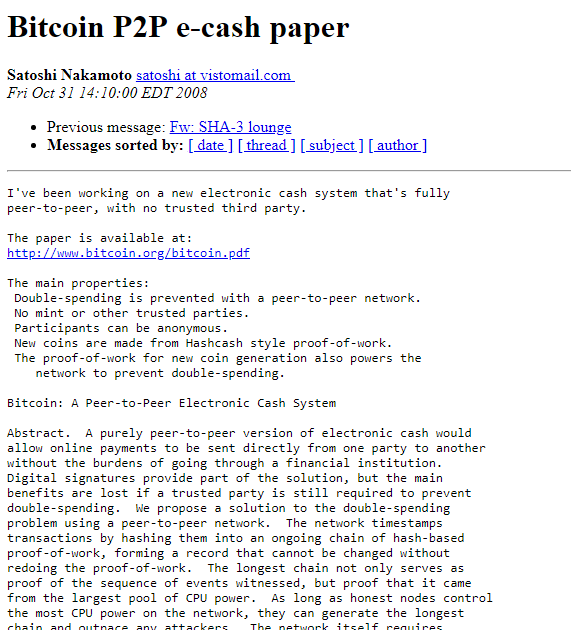

(₿): 11 years ago, someone sent an email that would change the world.

Newsletter #20: 20191024 - 20191101

Hello beautiful - it’s min a while. Here’s what I’ve seen in Bitcoin this week.

Hit ❤ above if you like this newsletter, or leave a comment below.

Last Week’s Most Read:

♎️ Mark Zuckerberg testified in front of Congress on the 23rd RE: Libra. If you missed the event, see this thread.

🔮 Eric Voskuil of Libbitcoin debunks The Hybrid Mining Fallacy - the theory that a combination of proof-of-work (PoW) and proof-of-stake (PoS) mining offers a higher level of system security than PoW.

Older Newsletters: 19, 18, 17, 16, 15, 14

Bitcoin Markets

Stats

XBT: $9150 📈22.8% WoW

Market Cap: $165 B 📈23% WoW

Dominance: 71.26% 📈 1.9% WoW

Hashrate: 89.86 EH/s 📉-11.6% WoW

Difficulty: 13.69 T 📈 5.2% WoW

Block Height: 601,931

Halvening: T-194 Days

Fiat Market Cap: #35 📈5 spots WoW

Global Debt: $60.000 T 📈 0.1% WoW

US Debt: $22.935 T 📈 0.4% WoW

Sources: Messari , BTC , BitcoinBlockHalf , FiatMarketCap , Economist , USDebtClock

Bitcoin / Lightning Tech

😔 Last week, I mentioned a story of how a user lost 4 BTC on Lightning because they couldn’t properly operate a Lightning Node. Apparently, it was fake news? I guess that’s what happens when I trust random redditors instead of verifying the on-chain data myself.

🛠 Bitcoin Optech Newsletter #70 highlights newly open-sourced material on their Schnorr + Taproot workshop. Schnorr and Taproot aim to improve the signing technology underlying Bitcoin - to enhance Bitcoin’s privacy and scalability.

⏱ BitMEX dives deep into Bitcoin’s Block Timestamp Protection Rules. They explore miners’ incentives to lie about time in order to adjust difficulty downwards and increase miner revenue via faster block times. Fortunately, Bitcoin has two mechanisms to protect against manipulation of the timestamp: Median Past Time and Future Block Time.

Bitcoin Companies / Projects

Wallets

📐 Coinkite, known for their coldcard and opendime hardware wallets, published all the info needed for users to build their own coldcards. Open source hardware initiatives (eg. M5stack, RISC-V) seem to be growing in lockstep with Bitcoin.

🔵 BlueWallet users will be able to buy and sell bitcoin from Hodl Hodl listings in late 2019 / early 2020.

Merchants

🏬 A retail condo in New York’s Upper East Side just sold for 1779 BTC (~$15.3 M). Is this the largest US-based real estate deal in Bitcoin’s history?

☕️ Bakkt is releasing a consumer app / merchant portal in H1 2020, with Starbucks as its launch partner. Remember Flexa? When are we going to get over the “pay for coffee with Bitcoin” meme?

Exchanges

📉 Deribit’s index calculator malfunctioned, causing the price of its perpetual swap contract to flash crash by 15%. The team is reimbursing about 150 BTC ($13 M) to traders who were affected.

🔍 Unfortunately, “the predominance of bad foundational data has undoubtedly limited institutional participation, negatively affected its acceptance by regulators, and ultimately stifled its growth.” Digital Asset Research explains why clean prices are absolutely essential for the market to mature.

📧 Fuck up #2: BitMEX accidentally doxed the majority of their customers' email addresses by using the CC function instead of BCC. It’s incredible how people still don’t know how to use email - guessing that an intern just got fired at BitMEX. #BitMEXrekt #BitMEXleak #BitMEXlekt

🚨 Last week, I shared a story on how Bitfinex accused Crypto Capital for holding its $850 M hostage. Without access to that money, Bitfinex felt compelled to conduct a billion dollar token sale earlier this year.

Well, Polish authorities just arrested Crypto Capital’s President and seized $350 M. The company is accused of being part of an international drug cartel and laundering its money through cryptocurrency exchanges, like Bitfinex. Bitfinex said it “is the victim of a fraud and is making its position clear to the relevant authorities, including those in Poland and the United States.”

Onto greener pastures…

📈 Established in 2015, Paxful now boasts over 3 million opened wallets on its marketplace, over 800k of which were opened in the past 12 months. The company noted that a lot of its growth came from arbitrage opportunities between highly liquid markets like the US and markets where bitcoins are more difficult to procure like Nigeria. In fact, 45% of their active users are based in Africa - read more about the platform’s explosive growth in Africa.

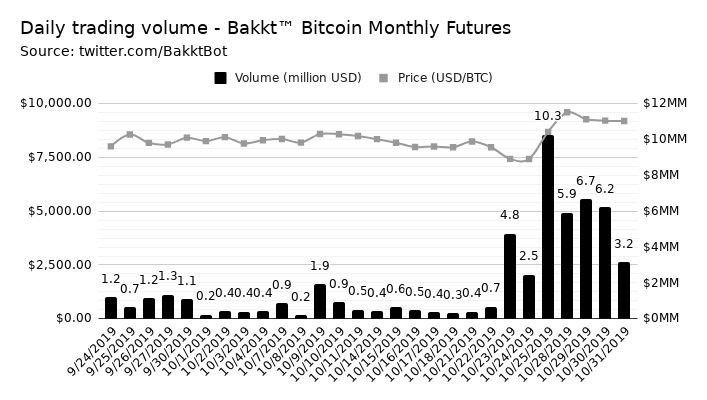

🧾 Bakkt aims to launch options contracts on December 9th, just months after launching its physically-delivered futures contracts. The ICE-backed exchange’s European-style options will settle into its monthly bitcoin futures contracts with time to roll, and traders have the choice to either close out positions or take physical delivery. Bakkt’s rival, the CME is also looking to launch its own bitcoin options contracts in Q1 of 2020, offering hedges against spot and futures positions.

💱 Binance added fiat to its crypto trading options, supporting Russian Rubles (RUB) and the Nigerian Naira (NGN). The exchange’s futures volumes also crossed the $1 B milestone earlier this week.

👌 OKEx is to launching futures contracts settled in tether (USDT) with leverage up to 100x on November 6th.

📱 Looking to gamble on the go? Kraken Pro is now on mobile.

Other

💵 The lending arm of the OTC trading subsidiary of Digital Currency Group (DCG), Genesis Capital, published their quarterly report, noting the growth in its cash and stablecoin lending (vs. bitcoin-based lending). “Genesis added $870 million in new loans and borrows in the third quarter, up 17 percent from the second. This is the sixth straight quarter that originations have increased, bringing the firm’s total amount lent and borrowed to $3.1 billion.”

📜 Paxos is testing a blockchain-based settlement service, as an alternative to the legacy infrastructure of the National Securities Clearing Corporation (NSCC). “Credit Suisse and Societe Generale are participating in the trial, which Paxos says will be the first time securities will trade outside of the legacy clearing system.”

🌌 Galaxy Digital is launching two new Bitcoin funds in November - one for accredited investors ($25k minimum investment w/ optional quarterly redemptions) and one for institutions (>$25k minimums w/ weekly withdrawals). Both will offer professional custody, tax, and support services.

🍁 After receiving a favorable ruling from the Ontario Securities Commission, 3IQ will be launching The Bitcoin Fund - a non-redeemable investment fund that will be listed for trading on major Canadian stock exchanges. The team worked with VanEck (who recently withdrew their ETF proposal with the SEC to pursue their limited ETP) to get through the finish line, and will be custodying their assets with Gemini.

⛏ Bitmain just filed for an IPO in the US with the SEC. They’re looking to raise between $300-500 M in the offering. This news comes after Bitmain’s recent corporate restructuring, where co-founder Micree Ketuan Zhan was ousted abruptly; Jihan Wu has now taken over his ex-co-CEO’s responsibilities. Though the team has made headlines in expanding their mining operations abroad to the US (as mentioned in last week’s newsletter), apparently 2019 has been a lackluster year for the company - they’ve been facing declining mining equipment market share and mining pool dominance. On the other hand, Canaan, WhatsMiner, and InnoSilicon have been gaining market share in the mining equipment space; Poolin and F2pool have been gaining mining pool dominance over Bitmain’s BTC.com and Antpool.

⛏ Canaan Creative, the second largest Bitcoin ASIC manufacturer behind Bitmain is also filing for an IPO ($CAN) on Nasdaq, with Credit Suisse, Citi, Galaxy, and others as its underwriters. The company looks to raise $400 M, touting H1 2019 global market share of Bitcoin miners of ~22%.

Why are these Chinese mining companies IPO-ing in the States? Well, China is a big fan of blockchain, not Bitcoin, and they’re looking to launch their own Renminbi-based “cryptocurrency”. These mining companies want to raise funds before China’s state-sponsored developments materialize.

🏭 Upstream Data Inc. specializes in the design and fabrication of Ohmm bitcoin mining data centers for stranded energy applications in oilfield. Here’s a case study by the team on how an Alberta oil producer was able to conserve stranded gas and eliminate gas flaring with the Ohmm datacenter, while earning BTC. #BitcoinFixesTheEnvironment

Bitcoin Talks / Theses

🐦 Twitter and Square CEO, Jack Dorsey, says “hell no” to Libra, stating: “I think the Internet is somewhat of an emerging nation-state in almost every way… It almost has a currency now in the form of cryptocurrency and bitcoin.” Rather than propose a new digital currency as the savior of the financial system, Square has embraced what already exists: bitcoin. Over the last year, the company has hired a team to contribute to the original cryptocurrency through Square Crypto. Read more on Dorsey’s thoughts on Bitcoin as the Internet’s native currency.

🏠 Casa explains why it’s important to run a Bitcoin full node, including benefits like greater privacy and security. Become a sovereign individual and run your own.

🚫 “How does anyone censor something abstract and intangible; something that can consist of an arrangement of numbers and letters, and can be transported via any medium? What do you do? Ban pen and paper? Phone calls and the spoken word? Smoke signals? Morse code? To what end?” Grubles breaks down why it’s difficult to censor Bitcoin. While on this topic, I recommend reading Eric Voskuil’s Other Means Principle.

💡 Nick Szabo (who many believe is Satoshi Nakamoto) joins Peter McCormack on WBD to chat about Bit Gold (the 2005 precursor to Bitcoin), the cypherpunk movement, the history of money, privacy, and more.

“Every time somebody gets censored, boom… they become a Bitcoin fan”

— Nick Szabo

🔀 The Deribit Insights team set out to identify patterns of contango and backwardation in Bitcoin derivatives markets. They note that high contango (spot price < futures price) often occurs during bullish periods where capital accrues to leveraged longs; backwardation (spot price > futures price) usually occurs when sudden market downturns trigger liquidations, reducing the demand for leveraged longs. “Empirically, backwardation has signaled long-term buying opportunities.”

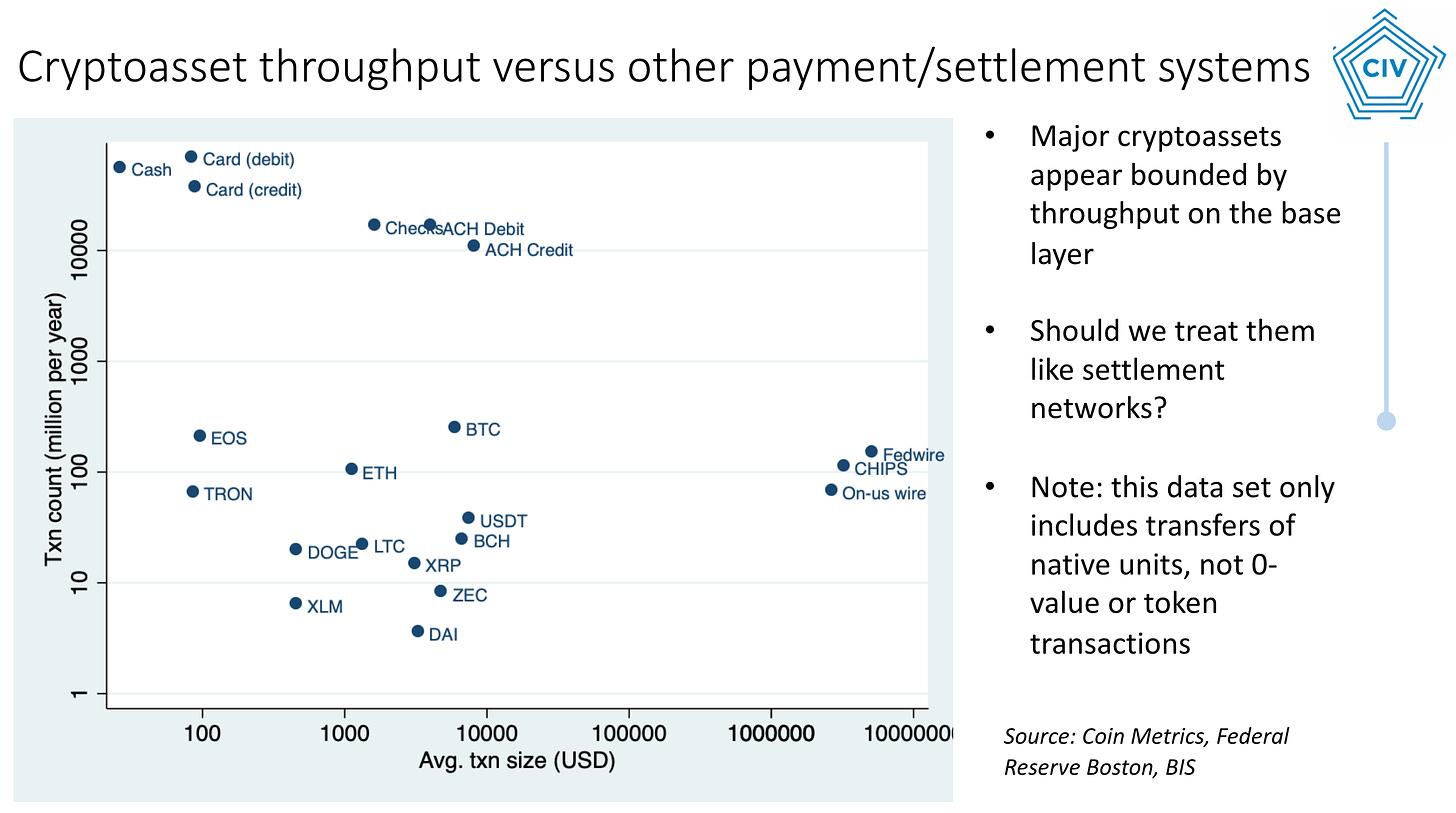

💳 Nic Carter breaks down cryptocurrencies vs. other payment systems like cash, ACH, and more, highlighting how cryptocurrency is not suitable for petty cash transactions.

Bitcoin Regulations

⛓ China’s President Xi Jinping is pushing for the country to lead in blockchain development, passing a new law to advance commercial cryptography technologies. “[We must] clarify the main direction, increase investment, focus on a number of key core technologies, and accelerate the development of blockchain technology and industrial innovation.” Of course, blockchain ≠ Bitcoin.

🤔 “The Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), Office of the Comptroller of the Currency (OCC) and the Federal Deposit Insurance Corporation (FDIC) have all signed onto the Global Financial Innovation Network (GFIN).” GFIN’s mission? Developing a global sandbox for financial innovations like cryptocurrency.

🗽 New York Department of Financial Services (NYDFS) Superintendent Linda Lacewell said the agency was reviewing the BitLicense, which requires any companies conducting cryptocurrency transactions with New York residents to be licensed to operate within the state – even if the companies are based elsewhere.

📲 AT&T said it would fight a suit accusing it of negligence in a customer’s loss of $1.7 million in a SIM swap. But jeez - AT&T employees have been taking bribes to plant malware for a while now. Please don’t use SIM-based 2FA!

Bitcoin Calendar

(x) Square Earnings Call | Nov 6

(x) Consensus: Invest 2019 | Nov 12

(x) The Capital | Singapore | Nov 12 - 13

(x) CME 6mo Expiration | Dec 27

(x) Wilshire Phoenix Bitcoin ETF Decision | Dec 28

Tweet at me if I’ve missed anything or if you’ve got feedback, questions, and comments.

This is not financial advice. Do your own research.

Newsletter #1 was published on 20190621. Stats:

XBT = ~$10,200

Market Cap = ~$180 B

Dominance = ~61.6%

Hashrate = ~60 EH/s

Difficulty = ~7.93 T