Hello beautiful - it’s min a while. Here’s what I’ve seen in Bitcoin this week.

Hit ❤ above if you like this newsletter, or leave a comment below.

Check out Michael Taiberg’s product review of the Coldcard MK3 hardware wallet.

Last Week’s Most Read:

📈 Established in 2015, Paxful now boasts over 3 million opened wallets on its marketplace, over 800k of which were opened in the past 12 months. The company noted that a lot of its growth came from arbitrage opportunities between highly liquid markets like the US and markets where bitcoins are more difficult to procure like Nigeria. In fact, 45% of their active users are based in Africa - read more about the platform’s explosive growth in Africa.

🌌 Galaxy Digital is launching two new Bitcoin funds in November - one for accredited investors ($25k minimum investment w/ optional quarterly redemptions) and one for institutions (>$25k minimums w/ weekly withdrawals). Both will offer professional custody, tax, and support services.

🔀 The Deribit Insights team set out to identify patterns of contango and backwardation in Bitcoin derivatives markets. They note that high contango (spot price < futures price) often occurs during bullish periods where capital accrues to leveraged longs; backwardation (spot price > futures price) usually occurs when sudden market downturns trigger liquidations, reducing the demand for leveraged longs. “Empirically, backwardation has signaled long-term buying opportunities.”

🏭 Upstream Data Inc. specializes in the design and fabrication of Ohmm bitcoin mining data centers for stranded energy applications in oilfield. Here’s a case study by the team on how an Alberta oil producer was able to conserve stranded gas and eliminate gas flaring with the Ohmm datacenter, while earning BTC. #BitcoinFixesTheEnvironment

Older Newsletters: 20, 19, 18, 17, 16, 15, 14

Bitcoin Markets

🐋 Academics recently claimed that a single account used USDT to unleash Bitcoin’s 2017 bull run. However, Ari Paul (CIO of BlockTower Capital) believes that the researchers are confusing Tether’s custodian with a lone whale.

Stats

XBT: $8825 📉 -3.5% WoW

Market Cap: $159 B 📉 -3.6% WoW

Dominance: 70.27% 📉 -1.4% WoW

Hashrate: 91.66 EH/s 📈 +2% WoW

Difficulty: 13.69 T 📉 -7.1% WoW

Block Height: 602,907

Halvening: T-188 Days

Fiat Market Cap: #35 👻 No Change WoW

Global Debt: $60.053 T 📈 0.1% WoW

US Debt: $23.024 T 📈 0.4% WoW

Sources: Messari , BTC , BitcoinBlockHalf , FiatMarketCap , Economist , USDebtClock

Bitcoin / Lightning Tech

⚡️ Lightning Network can be used as an end-to-end encrypted, onion-routed, censorship-resistant, peer-to-peer chat messages protocol.

🛠 “Gleb Naumenko (Chaincode Labs) sent an email to the Bitcoin-Dev mailing list suggesting that nodes and clients should signal to their peers whether or not they want to participate in address relay. This will avoid wasting bandwidth on clients that don’t want the addresses and can make it easier to determine the consequences of certain network behavior related to address relay.” Learn more about this address relay proposal on Bitcoin Optech Newsletter #71.

Bitcoin Companies / Projects

Exchanges

🔑 British Columbia Securities Commission (BCSC) seized control of the Einstein cryptocurrency exchange. The commission has received many complaints from customers who were unable to access their assets; the exchange owes its customers $12.4 million. Not your keys, not your coins. Participate in Proof of Keys on January 3rd.

⚖️ Bisq, a decentralized exchange, just introduced a new trade protocol that removes the influence of third-party arbitrators. These third-party actors can moderate disputes, but do not have control over funds.

“Removing the third key should make Bisq more resistant to legal concerns,” the developer explained. “Because they no longer have a key, dispute agents (mediators and arbitrators) don't need to be as highly trusted as before, so it will be easier to find dispute agents who can communicate in other languages as Bisq grows around the world.”

Bitcoin Talks / Theses

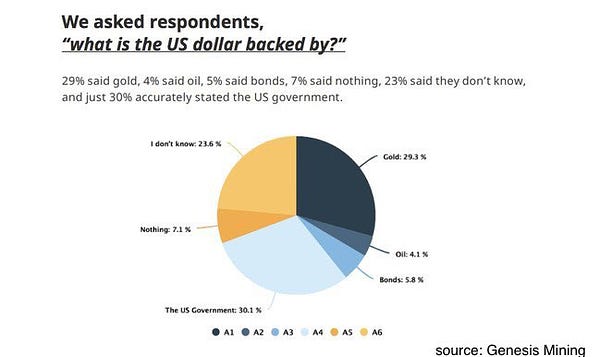

💱 Ray Dalio (Bridgewater) warns of a paradigm shift RE: world reserve currencies’ viability as storeholds of wealth, citing factors like cheap printed money, government deficits, and pension and healthcare obligations.

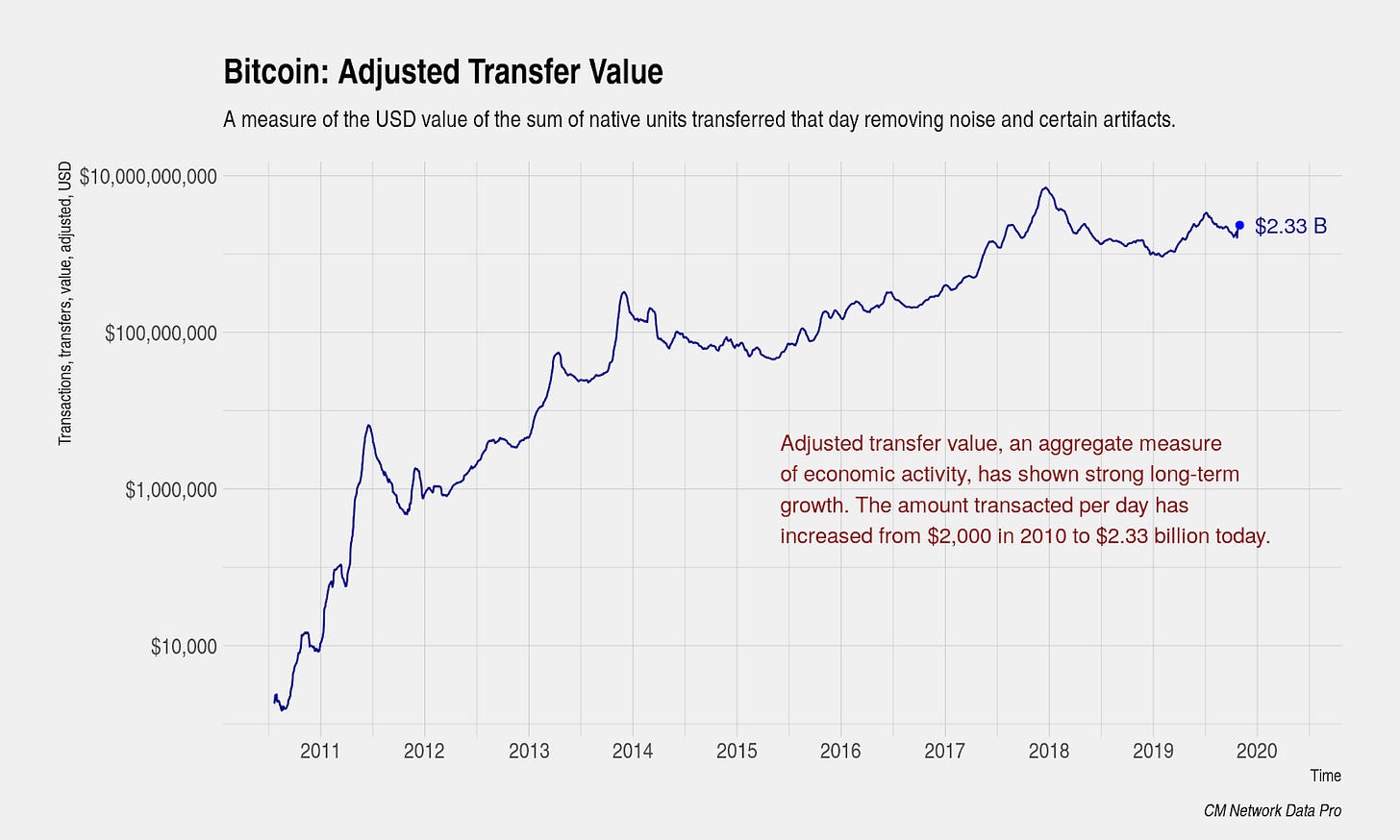

🌐 The Coin Metrics team proposes macroeconomic indicators for the Bitcoin economy, using metrics such as Adjusted Transfer Value and Block Size Capacity Utilization. I recommend giving it a read, for those of you looking to understand Bitcoin’s fundamentals.

🔺 Nik Bhatia states that Bitcoin is the Triumvirate of Liquidity. It acts as both digital gold and digital Treasuries, and has all the makings of the world’s next risk-free asset.

Bitcoin Regulations

🇺🇦 Binance, the world’s leading crypto exchange by volume, has signed a memorandum of understanding with the government of Ukraine to help develop regulations. The exchange will help Ukraine determine the legal status of virtual assets, as well as help the government develop “transparent and effective mechanisms” for crypto sales, and “beneficial conditions for investments and business in Ukraine”.

🇭🇰 The Hong Kong Securities and Futures Commission (SFC) introduced a new regulatory framework for centralized virtual asset trading platforms that list at least one security token. The framework addresses key investor protection concerns, including safe custody with hot and cold wallet guidance, insurance policies, as well as KYC/AML procedures.

📱 The Digital Currency Research Institute of the People’s Bank of China (PBoC), the country’s central bank, has signed an agreement with telecommunications giant Huawei.

Bitcoin Calendar

(x) Consensus: Invest 2019 | Nov 12

(x) The Capital | Singapore | Nov 12 - 13

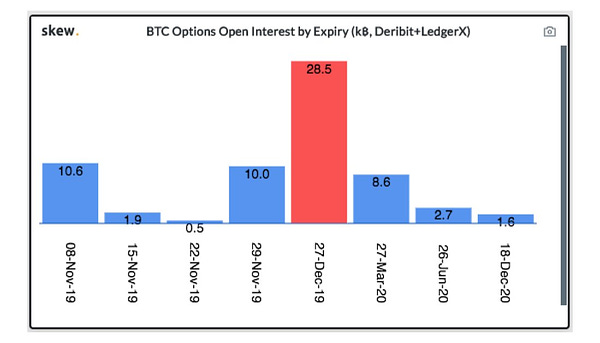

(x) CME 6mo Expiration | Dec 27

(x) Wilshire Phoenix Bitcoin ETF Decision | Dec 28

Tweet at me if I’ve missed anything or if you’ve got feedback, questions, and comments.

This is not financial advice. Do your own research.

Newsletter #1 was published on 20190621. Stats:

XBT = ~$10,200

Market Cap = ~$180 B

Dominance = ~61.6%

Hashrate = ~60 EH/s

Difficulty = ~7.93 T