Sorry for missing last week - US holiday…

Hello beautiful - it’s min a while, and it’s newsletter #24, which means I’ve been doing this for about half a year. If you’ve got any feedback for me, please reach out.

Here’s what I’ve seen in Bitcoin this week.

If you’ve found the newsletter helpful, hit the ❤ above and please share or leave a comment below.

Last Week’s Most Read:

▶️ Timeline visualization of Bitcoin’s mining distribution.

📩 The Block open-sourced their monthly report - lots of great content, covering topics like: where 42% of the industry’s employees work, deep dives on BitDEX, Silvergate, IEOs, and more.

📉 Ryan Todd (The Block) breaks down 2019 funding trends for the crypto industry.

Protesters burning down the Iranian central bank

Older Newsletters: 23, 22, 21, 20, 19, 18, 17, 16, 15, 14

Bitcoin Markets

Stats

XBT: $7460 📈 +1.5% WoW

Market Cap: $135 B 📈 +1.5% WoW

Dominance: 71.13% 📈 +1.0% WoW

Hashrate: 94.64 EH/s 📈 4.8% WoW

Difficulty: 12.88 T 📉-0.7% WoW

Block Height: 606,952

Halvening: T-160 Days

Fiat Market Cap: #40 👻 No Change

Global Debt: $60.259 T 📈 0.2% WoW

US Debt: $23.099 T 📈 0.2% WoW

Sources: Messari , BTC , BitcoinBlockHalf , FiatMarketCap , Economist , USDebtClock

Bitcoin / Lightning Tech

🤹♂️ Easypaysy is a layer 2 accounting system based on Bitcoin OP_RETURN data that preserves Bitcoin’s most valuable attributes like privacy and self-sovereignty, while enhancing the user experience with features like recurring payments and chargebacks. Aaron Van Wirdum of Bitcoin Magazine explains.

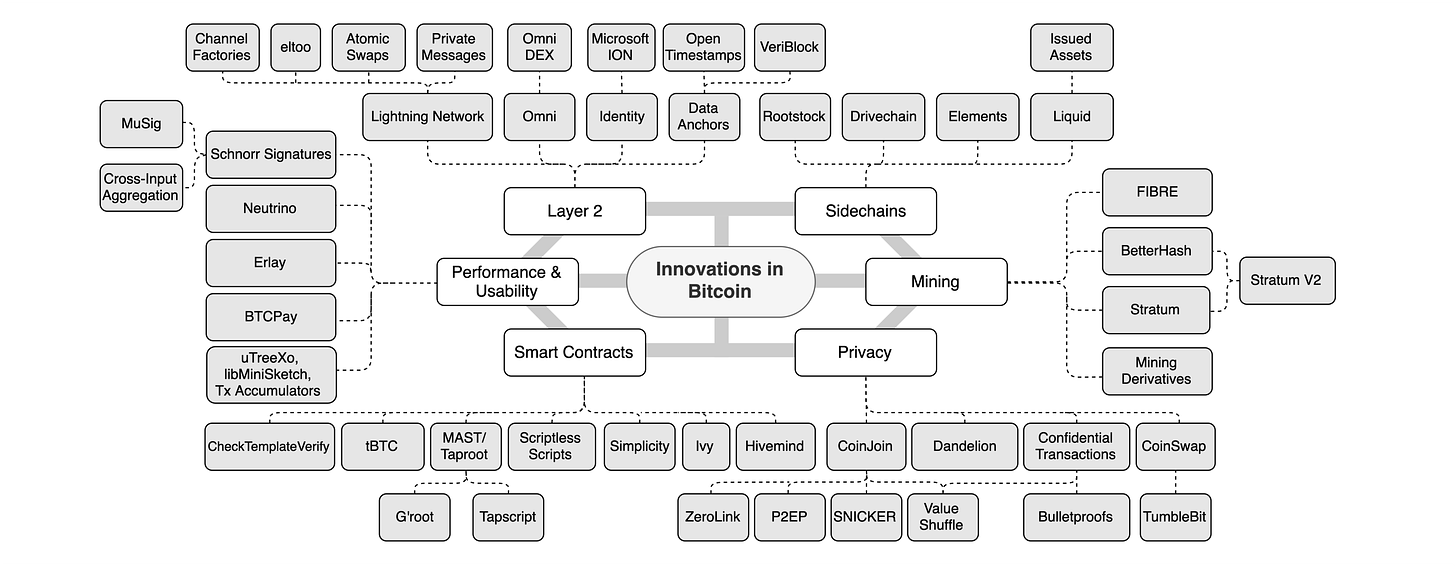

🛠 Digital Asset Research publishes A Look at Innovation in Bitcoin’s Tech Stack, debunking the “Bitcoin is old tech” meme.

🤔 Pieter Wuille of Blockstream breaks down the challenges of integrating confidential transactions (ie. hiding transaction amounts) into Bitcoin.

Bitcoin Companies / Projects

Wallets

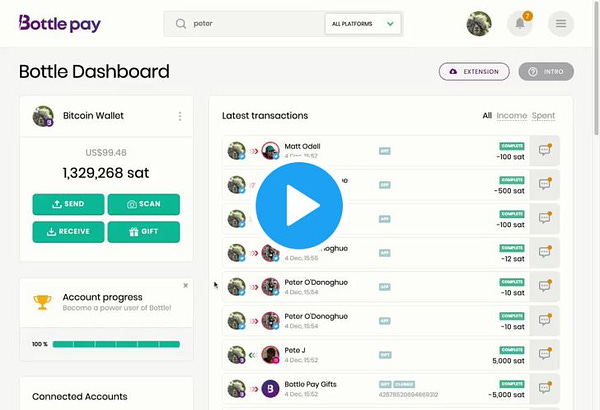

🍾 Bottle Pay expands beyond social media into chat apps via “gifts”.

Exchanges

⚡️ Bitfinex adopts the Lightning Network: users can now withdraw and deposit bitcoins into the exchange instantly over LN, a significant speed improvement compared to the 1-3 block confirmations (~10-30mins) when withdrawing or depositing funds on-chain. Additionally, Bitfinex has partnered with Bitrefill to enable customers to use LN to spend their bitcoins and buy items from the Bitrefill catalog. The two companies aim to “close the loop” in efforts to create a circular economy - a system that doesn’t depend on fiat currency.

🗽 The NYDFS grants popular personal finance software, SoFi, a BitLicense, allowing clients in New York to trade digital currencies through SoFi’s Digital Assets subsidiary.

🔜 Kelly Loeffler, the CEO of Bakkt, will take office on January 1, 2020 as one of Georgia’s new senators. Though Bakkt succession plans have yet to be revealed, it seems likely that the current COO and former Coinbase exec, Adam White, will take the helm. Bakkt plans to augment their physically-delivered bitcoin futures with a consumer-facing app for bitcoin payments, expanded custody services, as well as options and cash-settled futures in the months to come.

🏎 Ex-Morgan Stanley developers launch Phemex, a perpetual contracts derivatives exchange in Singapore. The exchange claims to be 10x faster than other platforms and offers up to 100x leverage. The 40-person team has already on boarded 2,000 clients and plans to acquire a license from the MAS in the near future.

🔁 BlockFi users can now trade their crypto with zero fees. The service instead plans to monetize its trading platform by selling user trade data to institutions who will act as market makers at BlockFi. Its trading platform is just one of the firm’s many new initiatives - having recently closed an $18.3 M funding round while growing its KPIs at a 1% daily clip, the company looks to rapidly expand its product offering.

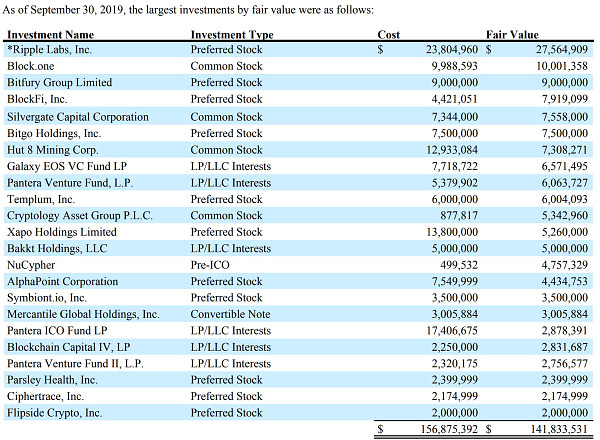

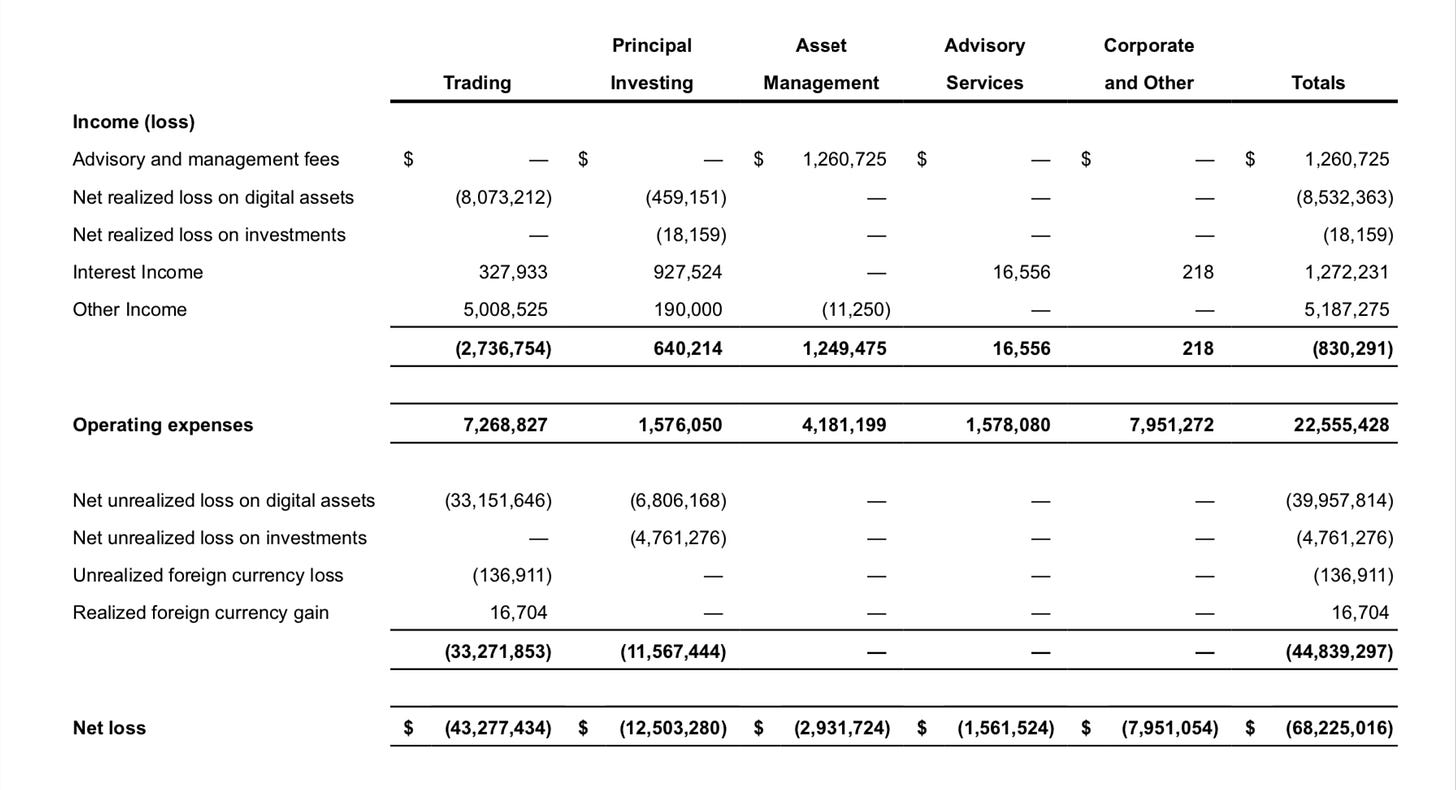

Funds + Asset Managers

🌌 Despite its profitability in the beginning of 2019, Galaxy Digital reported a net loss of $68.2 M in Q3, largely due to losses in its OTC trading practice.

📈 Canadian investment fund manager, 3iQ, has listed its preliminary prospectus for its bitcoin fund, bringing the company one step closer towards an IPO on the Toronto Stock Exchange. The company will custody its bitcoins with Gemini and expects trading to begin in late December or early January.

🏢 Rather than rearchitecting its front and back office infrastructure with dIsTrIbUtEd LeDgEr TeChNoLoGy, State Street will instead focus on cryptocurrencies, tokenized securities, and custody solutions. Cost pressures have forced the bank to cut over 100 internal blockchain developers, leading the company to instead look towards building partnerships with other providers.

According to a survey to be released next week, 94% of State Street clients hold digital assets or related products (e.g. bitcoin futures) and 38% of them said they will increase their allocation of digital assets in 2020. 45% said their allocation would stay the same, according to the survey, conducted for the bank this year by quantitative analysis firm Oxford Economics. Read more.

🌲 US asset manager, WisdomTree, launched a bitcoin ETP on the Swiss SIX stock exchange, highlighting demand for more traditional trading vehicles. The company currently oversees assets worth over $60 B.

Bitcoin Insights

Reports

📊 Larry Cermak of The Block publishes November by the Numbers:

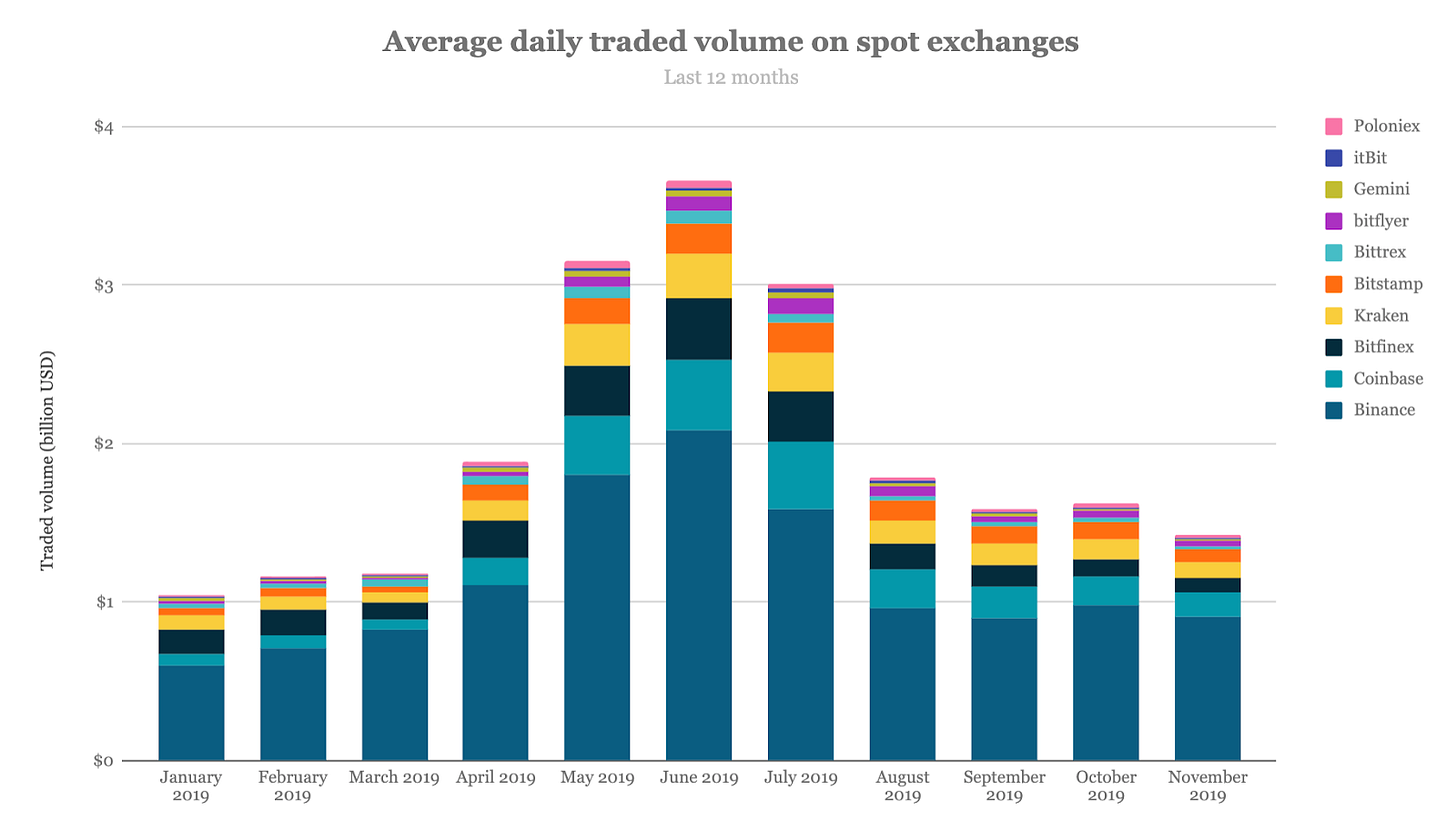

“Cryptocurrency traded volumes in November continued declining and hit an eight-month low

Grayscale holds 261,600 BTC or about 1.45% of the total circulating supply; nearly 55,000 bitcoins were added in 2019

CME continues to dominate Bakkt in terms of futures trading volume but the lead has been decreasing”

⛏ You may remember the flock of miners who are moving their operations over to Texas. Celia Wan of The Block crunches the numbers and finds that neither electricity rates nor infrastructure costs are favorable - so why are miners still choosing Texas? Turns out, regulatory stability is key.

🆓 The Messari team publishes how to earn free bitcoin.

📉 Crypto Fund Research reports that nearly 70 crypto hedge funds have closed this year, and the number of new funds that have launched this year is also less than half the number of launches in 2018.

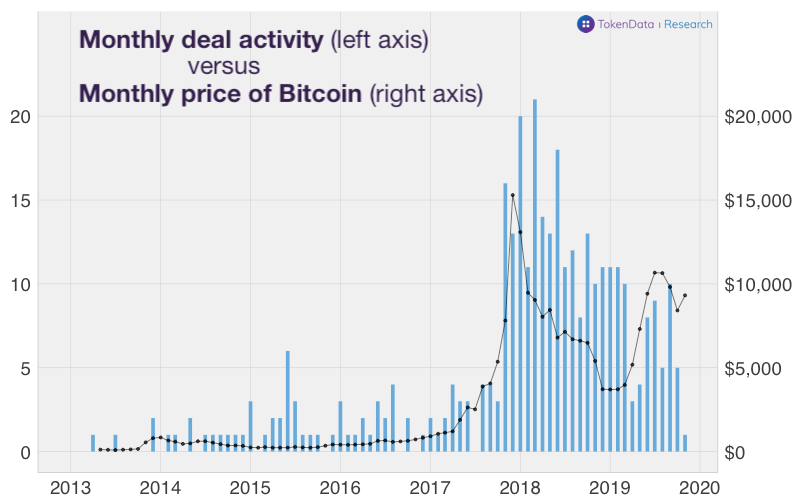

🤝 TokenData Research reviews crypto M&A, highlighting how over 350 acquisitions have been made since 2013 resulting in a total deal value of $4 B. Deal making is positively correlated to price and industry sentiment, and over 50% of M&A have been done by investment funds and exchanges. The report goes on to explain the different M&A strategies and the biggest deal makers in the space.

😉 Galen Moore of CoinDesk breaks down the Mechanics of Market Manipulation, citing thin markets on spot exchanges, faulty price indexes, and liquidation cascades on derivatives exchanges.

Podcasts

⭕️ Dan Matuszewski, Principal and Co-Founder of CMS Holdings, and previously Head of Circle Trade, joins On The Brink with Castle Island Ventures to discuss:

The secretive origins of Circle

Why banking was a big hindrance for early crypto companies

The genesis of Circle Trade and their relationship with Poloniex

Whether there is a market for 'virgin' coins

The nature of Tether and how it is used

The emergence of crypto volatility products

Bitcoin Regulations

🇬🇭 Ghana’s central bank considers issuing a digital currency (an e-cedi) to complement the growth of mobile money transaction volumes.

🇫🇷 French central bank governor François Villeroy de Galhau wants France to be the first country to create a digital currency. He looks to experiment with a French Digital Euro in Q1 of 2020, which will initially be used between banks, rather than by everyday citizens.

🇻🇬 The British Virgin Islands, home to cryptocurrency companies like Bitfinex, is looking to issue its own national cryptocurrency pegged to the US dollar.

🇿🇦 After a 5-year long consultation period, the central bank of South Africa is looking to introduce new rules and limits on the usage of cryptocurrency in order to prevent the evasion of its currency controls.

Bitcoin Calendar

(x) Boltathon | Dec 6 - 8

(x) Bakkt Cash-settled Monthly Futures Launch Singapore | Dec 9

(x) CME 6mo Expiration | Dec 27

(x) Wilshire Phoenix Bitcoin ETF Decision | Dec 28

(x) Bakkt Cash-settled Futures | Q4 2019

(x) 3iQ IPO | Q4 2019

(x) CME Options Launch | Jan 13

(x) Bitfinex Options Launch | Q1 2020

Tweet at me if I’ve missed anything or if you’ve got feedback, questions, and comments.

This is not financial advice. Do your own research.

Newsletter #1 was published on 20190621. Stats:

XBT = ~$10,200 📉-26.9% TD

Market Cap = ~$180 B 📉 -25% TD

Dominance = ~61.6% 📈 15.5% TD

Hashrate = ~60 EH/s 📈 57.7% TD

Difficulty = ~7.93 T 📈 62.4% TD