Hello beautiful - it’s min a while. Here’s what I’ve seen in Bitcoin this week.

Hit ❤ above if you like this newsletter, or leave a comment below.

Last Week’s Most Read:

Matt Corallo of Square Crypto presents Consensus Group Centralization, aka, “Why Proof of Stake is strictly worse than Libra, which is, itself, not a cryptocurrency consensus model, only a applied cryptography banking model”.

“Authentication online is still an unsolved problem. Most web platforms use social sign-in methods [Facebook, Google, etc.] which severely compromise your privacy, or they use simple email/password combinations which are easy to forget. Lightning Authentication solves this problem by allowing you to authenticate without giving up any private information,” Gomes told Decrypt.

A Bitcoin statistician attempts to falsify Plan ₿’s Stock-to-Flow Model. TLDR? “Bitcoin is the drunk and Stock-to-Flow is the road home.”

Older Newsletters: 18, 17, 16, 15, 14

Bitcoin Markets

Stats

XBT: $7450 📉-6.5% WoW

Market Cap: $134 B 📉-6.2% WoW

Dominance: 69.92% 📉-0.1% WoW

Hashrate: 101.61 EH/s 📈 8.7% WoW

Difficulty: 13.69 T 📈 5.2% WoW

Block Height: 600,856

Halvening: T-202 Days

Fiat Market Cap: #40 📉3 spots WoW

Global Debt: $59.939 T 📈 0.1% WoW

US Debt: $22.838 T 📈 0.3% WoW

Sources: Messari , BTC , BitcoinBlockHalf , FiatMarketCap , Economist , USDebtClock

Bitcoin / Lightning Tech

🛠 Bitcoin Optech Newsletter #69 introduces the Taproot Review, where Bitcoin Core contributors will review the proposed BIP-schnorr, BIP-taproot, and BIP-tapscript changes. These Bitcoin Improvement Proposals (BIPs) have been proposed by Pieter Wuille (Blockstream, known for his contributions to standards like hierarchical deterministic wallets and SegWit) and aim to offer Bitcoin greater smart contract functionality, privacy, and scale. Those involved in the Taproot Review are expected to commit 4hrs/week for 7 weeks. Sign up here.

🌀 Samourai releases a free and open-source command line tool that will allow Whirlpool users to determine Anon Set scores from their Whirlpool Coinjoin transactions, as well as observe the overall scores of the entire pool. Here’s a primer on Coinjoin transactions for those who are unfamiliar.

⛓ Kyle Torpey explores the trade offs of Bitcoin sidechains, which introduced a way for developers to experiment with new potential features to Bitcoin without having to roll out their own altcoin.

💡 Atomic Loans explains how Ledger users can save up to 80% on transaction fees by upgrading to SegWit. SegWit is an engineering miracle that has - among other things - enabled second layer solutions like the Lightning Network to operate on Bitcoin, and marks a cornerstone event in Bitcoin’s history.

⚡️ Thomas Voegtlin explains how Lightning works in the Electrum wallet. Electrum has been around since 2011 and continues to be a favorite amongst Bitcoin power users.

🔑 Chris Stewart breaks down how exchanges should manage their private keys in the context of the Lightning Network.

💨 Lightning compounds Bitcoin’s UX challenges, but Breez wallet is looking to offer potential solutions. Recently, they introduced their latest solution, Lightning Rod, which enables the receiver a Lightning payment to be offline.

😔 But until those UX solutions exist, Lightning will still continue to be difficult for the average joe to use; this week, one user lost 4 BTC on Lightning because they couldn’t properly operate a Lightning node.

Bitcoin Companies / Projects

Exchanges

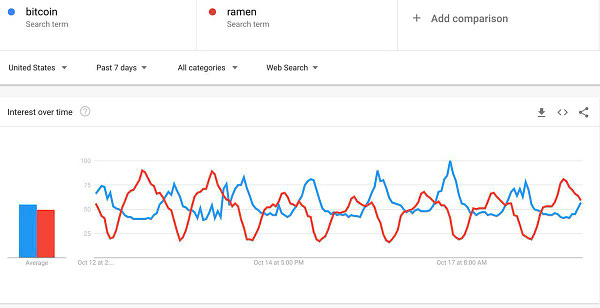

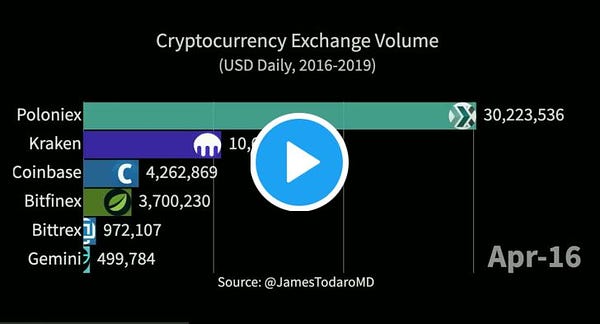

📈 Binance has been on a tear lately, adding FDIC insurance for their US-based customers and beginning to add fiat pairs - starting with the Russian Ruble - in the coming weeks. They’ve been dominating retail cryptocurrency spot trading volumes:

📉 On the other hand, Bitfinex and their parent company, iFinex, have been struggling. According to a recent CoinMetrics newsletter, the exchange’s market share dropped from 30 to 20% over the past 6 months. Speculators point at two major catalysts:

Remember when Bitfinex / iFinex was accused of covering an $850 M+ deficit by the NYAG? Apparently those funds are being held hostage by Crypto Capital / Global Trade Solutions, a payment processor whose bank accounts in several countries have been seized or frozen by government agencies. iFinex has since filed an application for discovery.

Bitstamp and other exchanges are offering new cheaper fee models, poaching many of Bitfinex’s whales.

Other

⛏ Last week, I mentioned Layer1, a company that just raised $50 M to build out a vertically-integrated mining facility in Texas over a few dozen acres. This week, BitMain announced it is building a mining facility in Texas as well - the world’s largest. The 33,000-acre site currently has a 25MW capacity with the ability to scale up to over 300MW in the future.

📱 HTC unveiled their latest device at the Lightning Conference in Berlin this past weekend, enabling anyone to run a full Bitcoin node from their phone. Some benefits of running your own full node include minimizing trust in third party providers and gaining greater privacy RE: your Bitcoin transactions. For those with a spare Android device who don’t want to shell out the $244 for the new device, Matt Odell recommends ABCore.

📲 While on the topic of mobile innovation, the Opera Android browser announced that it now supports bitcoin payments. Bitcoin-native browsers will be critical in not only enhancing the overall usability and automation of Bitcoin transactions, but also inspiring totally novel applications in the Internet of Money.

🎮 Satoshis Games has announced LightNite: A Bitcoin-integrated battle royale game. I’m guessing it’s just like Fortnite (though I’ve never played either). If you like gaming, here’s your chance to stack some sats while playing.

🏢 Having announced Fidelity Digital Assets last year, Fidelity has finally begun onboarding clients earlier this year, offering enterprise-grade custody and trade execution services. Though Coinbase Custody stores billions of dollars worth assets on behalf of its clients (compared to Fidelity’s trillions of dollars AUM), it’s “still a company that most people had never heard of, and they don’t have the existing relationships with the independent advisers.” CEO Abigail Johnson explains her excitement to offer institutional services to hedge funds, family offices, and financial advisers in this fragmented and complicated industry.

📃 It seems like others are joining in the institutional services realm as well, with startups like BlockFi formally entering the fray. “BlockFi Institutional Services provides bespoke financing solutions that allow clients access to a variety of cryptocurrencies for executing trading strategies and hedging their positions, amongst other opportunities.”

The company has also updated their loan application process. But not all customers are happy with the company’s operations; one user explains why he’ll never use BlockFi again for a personal loan, citing a lack of concern for clients’ privacy.

Bitcoin Talks / Theses

💸 José Niño writes an op-ed on why Argentina needs Bitcoin. With the backdrop of their upcoming presidential elections, projected inflation of ~50%, and rumors of default, citizens look towards Bitcoin to store their wealth rather than remaining hostage to their local economic policies.

🧽 (no gold emoji, so here’s a sponge instead). Though we Bitcoiners like to tout Bitcoin as a better, programmable gold, Dan Tapiero explains why both Bitcoin and gold are important.

🌙 Bitcoin educator, Justin Moon, joins Tales From The Crypt to chat about his education bootcamps, open-source hardware wallets, hardware wallet interaction scripts / interoperability, and more.

🔮 Eric Voskuil of Libbitcoin debunks The Hybrid Mining Fallacy - the theory that a combination of proof-of-work (PoW) and proof-of-stake (PoS) mining offers a higher level of system security than PoW.

⚡️ Alex Bosworth of Lightning Labs discusses submarine swaps, loop, and hyperloop on the Stephan Livera podcast, and how these kinds of innovations make Lightning more usable.

Bitcoin Regulations

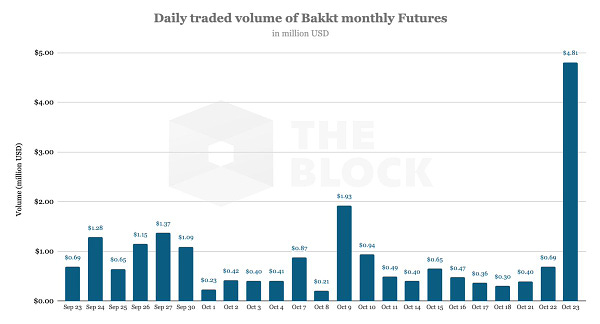

🔪 Christopher Giancarlo, who ended his five-year term as chairman of the CFTC told CoinDesk that the Trump administration acted to deflate the bitcoin bubble of 2017 by allowing the introduction of futures products. Access to derivatives and shorts enabled the market to bring down the prices. “Bitcoin futures listed by the Chicago Mercantile Exchange (CME) and the CBOE Futures Exchange (CFE) were announced by the CFTC on Dec. 1, 2017 and went live on Dec. 18. Bitcoin’s price peaked at nearly $20,000 one day earlier, on Dec. 17, before falling dramatically in subsequent weeks.”

♎️ Mark Zuckerberg testified in front of Congress on the 23rd, warning that the US might lose its financial leadership if Libra isn’t allowed to launch. He mentioned that Facebook would be forced to leave the Libra Association if it chooses to move forward without the green light from US regulators. If you missed the event, see this thread:

Given their lack of traction on the SDR-basket approach, the association is considering to instead launch a series of fiat-pegged “stablecoins”.

🔒 But even that strategy may not work. The FATF recently called stablecoins a growing threat to monetary policy, financial stability, competition, in addition to enabling money laundering and terrorist financing. Earlier in June, the FATF called on national financial services and banking regulators to require virtual asset service providers to implement strict KYC/AML policies.

🔍 David Jevans, CEO of CipherTrace, urges the industry to carefully consider unintended consequences of FATF: “As we get more of this deanonymization and it becomes more like banking, I think an unintended consequence will be there will be concerted effort to use these privacy-enhanced coins.”

Bitcoin Calendar

(x) CME 3mo Expiration | Oct 25

(x) Square Earnings Call | Nov 6

(x) Consensus: Invest 2019 | Nov 12

(x) The Capital | Singapore | Nov 12 - 13

(x) CME 6mo Expiration | Dec 27

(x) Wilshire Phoenix Bitcoin ETF Decision | Dec 28

Tweet at me if I’ve missed anything or if you’ve got feedback, questions, and comments.

This is not financial advice. Do your own research.

Newsletter #1 was published on 20190621. Stats:

XBT = ~$10,200

Market Cap = ~$180 B

Dominance = ~61.6%

Hashrate = ~60 EH/s

Difficulty = ~7.93 T