Like the new name?

Hello beautiful - it’s min a while. Here’s what I’ve seen in Bitcoin this week.

Hit ❤ above if you like this newsletter, and feel free to share or leave a comment below.

Last Week’s Most Read:

📩 The Block open-sourced their monthly report - lots of great content, covering topics like: where 42% of the industry’s employees work, deep dives on BitDEX, Silvergate, IEOs, and more.

🧰 Vlad Costea (Bitcoin Magazine) attempts to find out what’s the best hardware wallet on the market in a three-part series: one, two, and three.

📉 Ryan Todd (The Block) breaks down 2019 funding trends for the crypto industry.

🌚 Researchers at Carnegie Mellon University present TendrilStaller, an eclipse attack targeting Bitcoin’s peer-to-peer network. They then propose respective countermeasures.

Older Newsletters: 22, 21, 20, 19, 18, 17, 16, 15, 14

Bitcoin Markets

Stats

XBT: $7350 📉 -13% WoW

Market Cap: $133 B 📉 -13% WoW

Dominance: 70.38% 📈 +0.7 WoW

Hashrate: 90.32 EH/s 📉-5.1% WoW

Difficulty: 12.97 T 📈 +1.9% WoW

Block Height: 604,948

Halvening: T-173 Days

Fiat Market Cap: #40 📉 -5 WoW

Global Debt: $60.156 T 📈 0.1% WoW

US Debt: $23.062 T 📈 0.1% WoW

Sources: Messari , BTC , BitcoinBlockHalf , FiatMarketCap , Economist , USDebtClock

Bitcoin / Lightning Tech

ℹ️ You’ve probably seen me mention Bitcoin Improvement Proposals (BIPs) in my previous newsletters. Bitcoin Magazine breaks down exactly what they are and how they get adopted.

♻️ Earlier this week, Binance consolidated UTXOs within their Tether wallet, converting their “loose change” into “larger bills”. By doing so, they save all Bitcoin node operators a lot of disk space and RAM. To learn more about UTXO consolidation, dust, and fee scheduling, I recommend reading through these resources.

🧠 The team behind the mining protocol Stratum v2 (eg. Braiins, Matt Corallo of Square Crypto, and Peter Todd of OpenTimestamps) recently hosted an AMA.

Bitcoin Companies / Projects

Wallets

📲 Rodolfo Novak teases QR codes for the Coldcard hardware wallet device, allowing Coldcard users to receive bitcoin payments in a 100% air-gapped, private fashion.

📋 Veriphi, a Canadian Bitcoin consultancy, recently published their analysis on different software wallets. Comparing 48 different features, the group makes recommendations based on notions of security, anonymity, and sovereignty.

🔀 Wasabi Wallet just raised $337.5 K at a $7.5 M valuation from Cypherpunk Holdings. The wallet charges fees for its CoinJoin functionality, with estimated revenues over a 3-month period at $1 M. “Both wallets, and privacy-enabling services, have very impressive network effects in that the more participants there are, the more private each participant is,” Cypherpunk’s CIO Moe Adham said. Learn how Wasabi plans to capture more market share, for both personal and enterprise use cases.

Exchanges

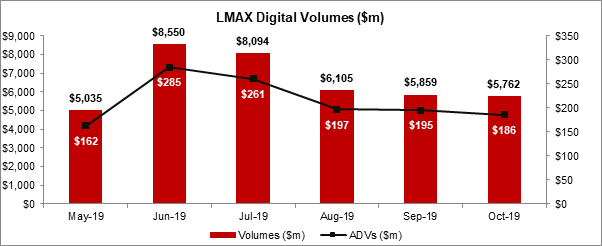

📈 LMAX Digital recently hit a record high in monthly volumes. Listen to The Scoop to learn more about what differentiates LMAX digital from other crypto “exchanges” (highly recommended for those unfamiliar with traditional secondary markets infrastructure).

💵 On December 9th, Bakkt will offer BTC-USD cash-settled monthly futures at ICE Futures Singapore. “Building off the success of our deliverable futures contract, the cash settled futures will leverage ICE’s regulated, globally-accessible market to offer a safe, secure and compliant environment for the trading of bitcoin.” Currently, the only derivatives exchange to offer cash-settled Bitcoin futures contracts is the CME Group.

📱 Bisq, the privacy-oriented P2P bitcoin exchange, is beginning to develop their mobile app.

Custody

🔒 Fidelity Digital Asset Services (FDAS) just received a trust company charter from the NYDFS, joining 22 other custodians who had previously been approved. The company will lean on its brand name to attract more clients, touting that they’ve already been receiving inquiries from pension funds and endowments. Learn more about the company’s clientele and unique differentiators in the already competitive crypto custody space.

Mining

🎉 Canaan, the second largest Bitcoin mining manufacturer, IPO’d on the Nasdaq this week, raising $90 M.

⛏ You may recall in newsletters 18 and 19 that Layer1 and Bitmain are building mining facilities in Texas - but they’re not the only ones. By the end of 2020, the largest Bitcoin mining facility, flaunting energy capacity of 1 gigawatt over 100 acres, will come into existence. Learn more about the joint venture between Whinstone (a US-based developer of high-speed data centers) and Northern Bitcoin (a Norwegian mining operation that claims to run on 100% renewable energy), and their 2020 roadmap.

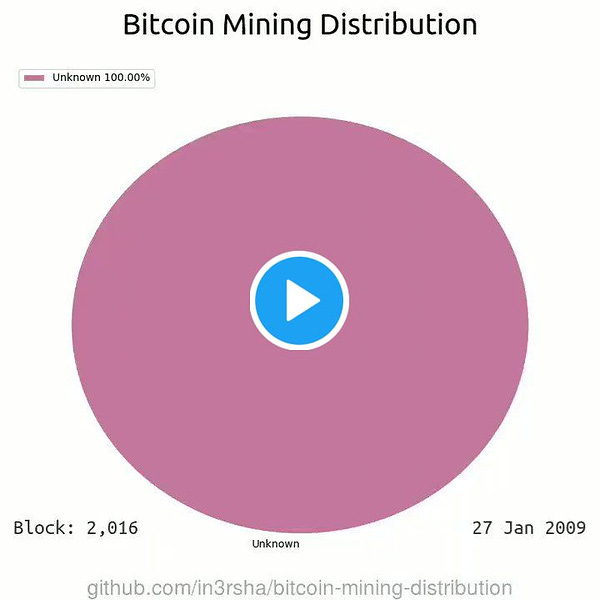

▶️ Timeline visualization of Bitcoin’s mining distribution.

Funds

🌌 As you might remember from newsletter 21, Galaxy Digital is launching two new funds, targeting accredited and institutional investors. The funds will work with custodians Bakkt and Fidelity, and aim to differentiate themselves from competitors like Grayscale and other exchange traded products through lower fees. But are low fees enough to compete?

💼 Grayscale, the asset manager behind the Bitcoin trust fund, GBTC, has filed a Form 10 to register GBTC as the first SEC-reporting company in the cryptocurrency space. If approved, the Trust would raise the bar for financial reporting and offer investors faster access to secondary market liquidity. By offering a more familiar structure, Grayscale hopes to tap into a wider institutional investor base that prefers to invest in popular registered products.

💰 Sam Cassatt, former CSO of ConsenSys, has just opened up his new venture fund, Aligned Capital. The first fund aims to invest $50m in artificial intelligence, healthcare, cryptocurrency, and blockchain.

Other

🔫 Bitcoin Bounty Hunt is a fully lightning-native multiplayer FPS:

🔥 5-year-old Chainalysis laid off 20% of its workforce, in attempts to streamline its path to profitability with exchanges, banks, and governments.

Bitcoin Insights

Reports

💻 Larry Cermak of The Block published an analysis that compares exchanges’ website traffic volumes to their trading volumes. He found that Bitfinex and Bitstamp have the largest traders while Poloniex, Bittrex, and Coinbase have mostly retail clients.

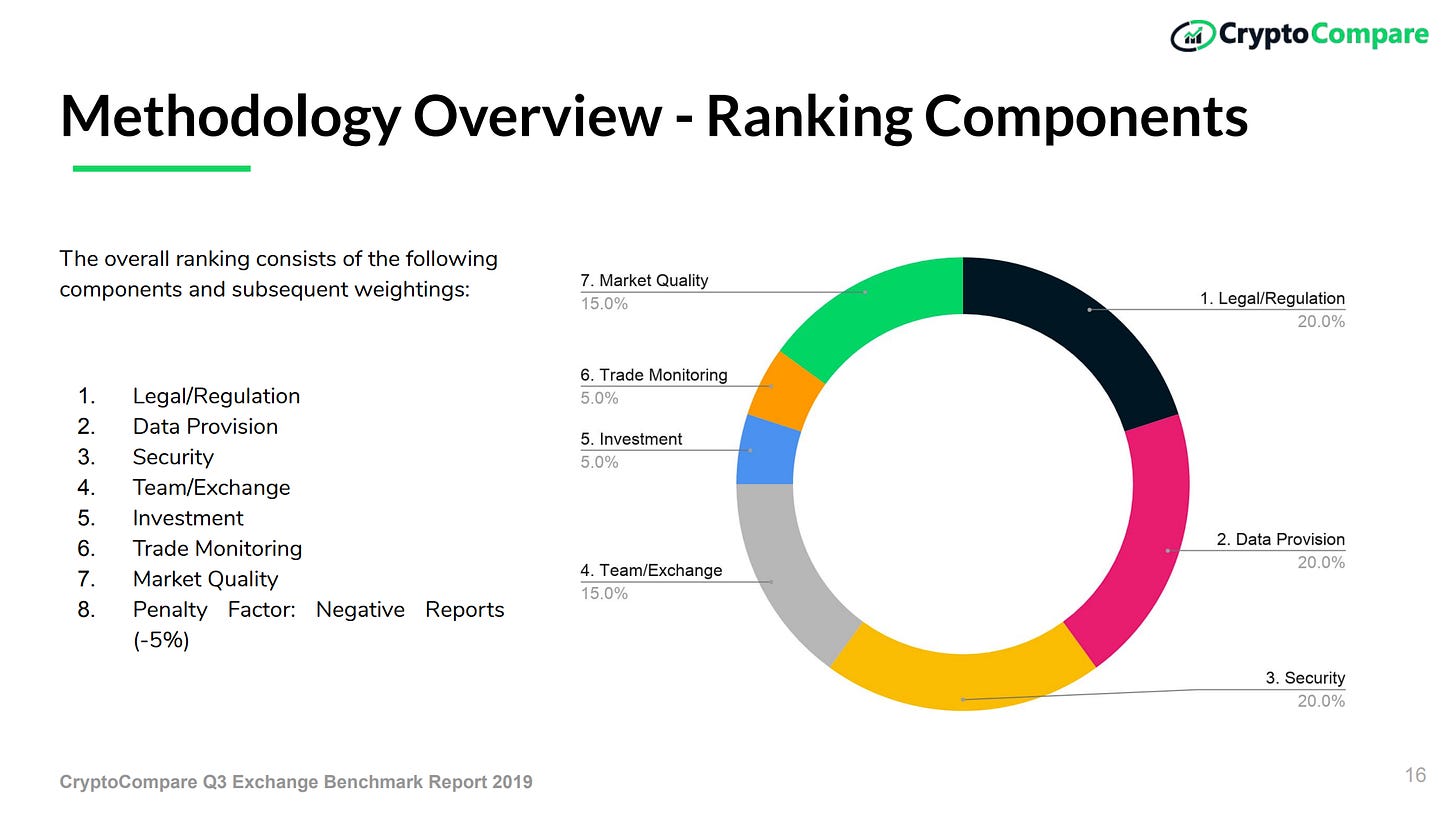

📊 CryptoCompare Research shared their Exchange Benchmark Report, ranking Gemini, itBit, and Coinbase in the top tier, and OKCoin, Huobi, Bittrex, and others in the bottom tier. Read the full report to learn more about their ranking methodology and other insights.

⛓ BitMEX Research and CoinMetrics teamed up to present the successor to P2SH.info, TXStats.com. The site focuses on displaying bitcoin transaction types, charting the usage of multi-sig, SegWit, OP_Return, and more.

🚀 As portrayed in this video, Binance has clearly begun dominating the crypto exchange market. Tim Copeland of Decrypt dove deep into the exchange’s explosive growth and published an article on Binance’s rise to power.

🤦♂️ Most victims who get scammed out of their crypto (note: not even victims of shitcoins; just victims of simple trust-trading scams) are based in Indonesia, Nigeria, the US, and Vietnam. Learn more about the types of scams being perpetrated.

🛰 Leigh Cuen (Coindesk) on how protests in Hong Kong, Lebanon, and Iran reveal Bitcoin’s limitations. Though there are censorship-resistant tools available for using Bitcoin without Internet (eg. blockstream satellite, gotenna, HAM radio, sneakernet opendimes), “both the Chinese and Iranian bitcoiners who spoke to CoinDesk pointed out that most people don’t have the skills, nor the desire, to go ‘the anarchist route,’ as the Chinese bitcoiner put it.”

Theses

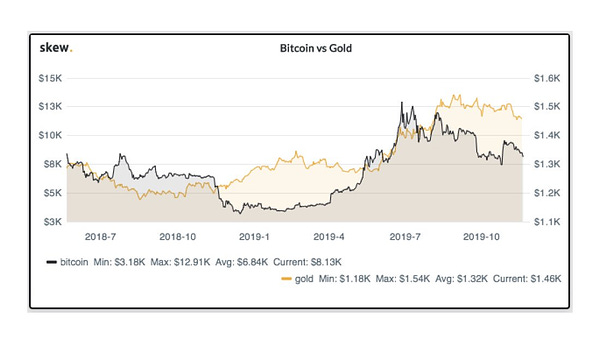

📈 Emmanuel Goh, co-founder & CEO of skew, published: Crypto Derivatives: A Corner of the Market or the Market Itself? In it, he covers how the 2018 bear market led to the growth of Bitcoin futures markets, and how the derivatives landscape will change as the market matures.

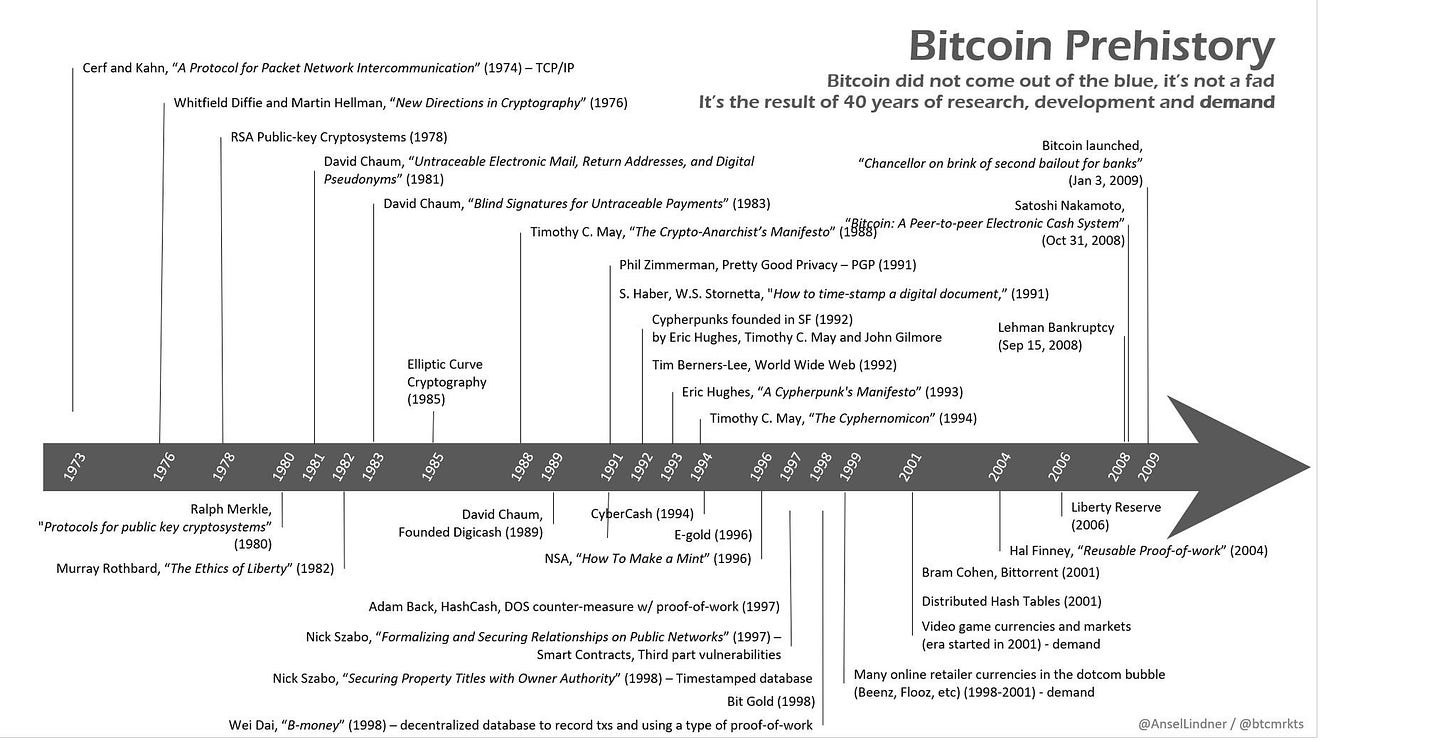

🗂 @AnselLindner and @btcmrkts break down Bitcoin’s prehistory. The graphic below should help readers understand the context behind the Bitcoin community’s design decisions when it comes to censorship resistance.

🤵 Thread on the Sovereign Individual investment thesis:

👨🏫 Willy Woo of Adaptive Capital and Woobull Charts breaks down how to explain Bitcoin to precoiners.

Podcasts

⚛️ Thomas Voegtlin, Bitcoiner since 2010 who founded Electrum Wallet in 2011, joins Stephan Livera to chat about Electrum, seed phrases, PSBT, Multisig, Lightning, and more.

📊 Max Boonen, founder of B2C2, explains how B2C2 rose to become one of the world's largest OTC liquidity providers.

Bitcoin Regulations

🕵️♂️ REPORTEDLY (!!!), Binance’s Shanghai office was raided by local police. But no one knows for sure. Apparently the PBoC is cracking down on crypto exchanges in Shanghai, but TBD… China FUD is always difficult to decipher.

🏃♂️ The US Federal Reserve Board warned of how a run on the issuers of stablecoins could wreak havoc. They proposed an outline on the steps issuers must take to protect the status quo in the November edition of its semiannual “Financial Stability Report”. Powell said the Fed is exploring issuing a stablecoin, but hasn’t found convincing reasons to do so.

📃 Two members of Congress proposed the Managed Stablecoins and Securities Act of 2019. The bill, if passed, would classify managed stablecoins as securities.

🔍 The SEC is taking a second look at the rejection of Bitwise’s Bitcoin ETF proposal. It’s not clear what triggered the review and there are no set deadlines for the process.

🤠 There’s a way cryptocurrency businesses can get around New York’s notoriously hard-to-get BitLicense (only 18 have been granted in the rule’s 5 years of existence), and it runs through Wyoming’s Special Purpose Depository Institutions (SPDIs) - a new type of fully-reserved fiat bank that can also custody crypto assets. Read more about Wyoming’s SPDI, its requirements, its ability to supersede the BitLicense, etc.

🇸🇬 The Monetary Authority of Singapore (MAS) proposed to allow crypto derivatives on approved local exchanges including Asia Pacific Exchange, ICE Futures Singapore, Singapore Exchange Derivatives Trading, and Singapore Exchange Securities Trading Limited. “A well-regulated market for derivatives – particularly one anchored by institutional investors with sophisticated risk management and investment strategies – can serve as a more reliable reference of value for the underlying asset.”

⚖️ The UK Jurisdiction Taskforce of the Lawtech Delivery Panel now recognizes crypto assets as "tradable property" and defines smart contracts as "enforceable agreements".

Bitcoin Calendar

(x) Boltathon | Dec 6 - 8

(x) Bakkt Cash-settled Monthly Futures Launch Singapore | Dec 9

(x) CME 6mo Expiration | Dec 27

(x) Wilshire Phoenix Bitcoin ETF Decision | Dec 28

(x) Bakkt Cash-settled Futures | Q4 2019

(x) CME Options Launch | Jan 13

(x) Bitfinex Options Launch | Q1 2020

Tweet at me if I’ve missed anything or if you’ve got feedback, questions, and comments.

This is not financial advice. Do your own research.

Newsletter #1 was published on 20190621. Stats:

XBT = ~$10,200 📉-27.9% TD

Market Cap = ~$180 B 📉 -26.1% TD

Dominance = ~61.6% 📈 14.3% TD

Hashrate = ~60 EH/s 📈 50.5% TD

Difficulty = ~7.93 T 📈 63.6% TD